Differentiate Your Business And Deliver Stronger Client Portfolios

iCapital Architect is our award-winning1 portfolio construction tool that empowers advisors to design portfolios with alternatives and structured investments and illustrate their impact to clients with ease.

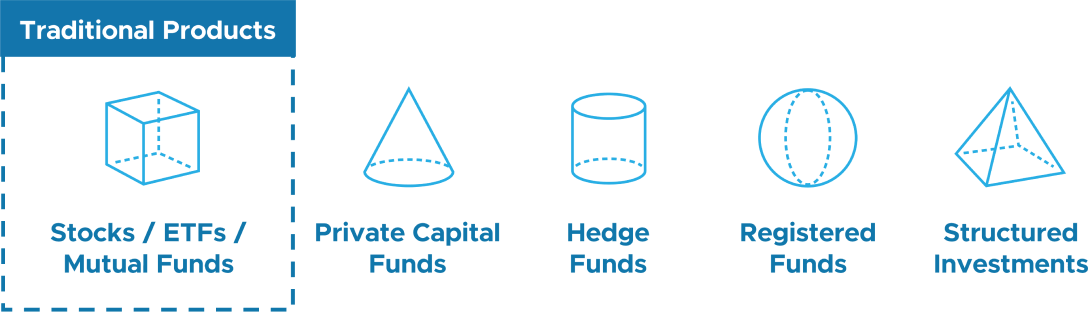

Build Beyond The Box

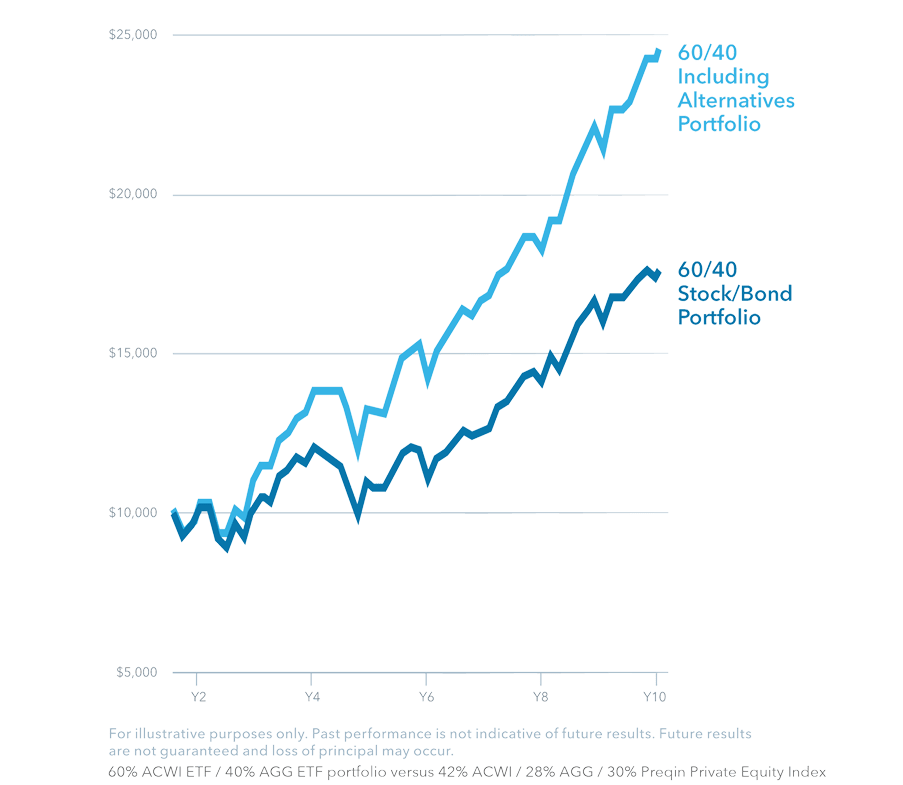

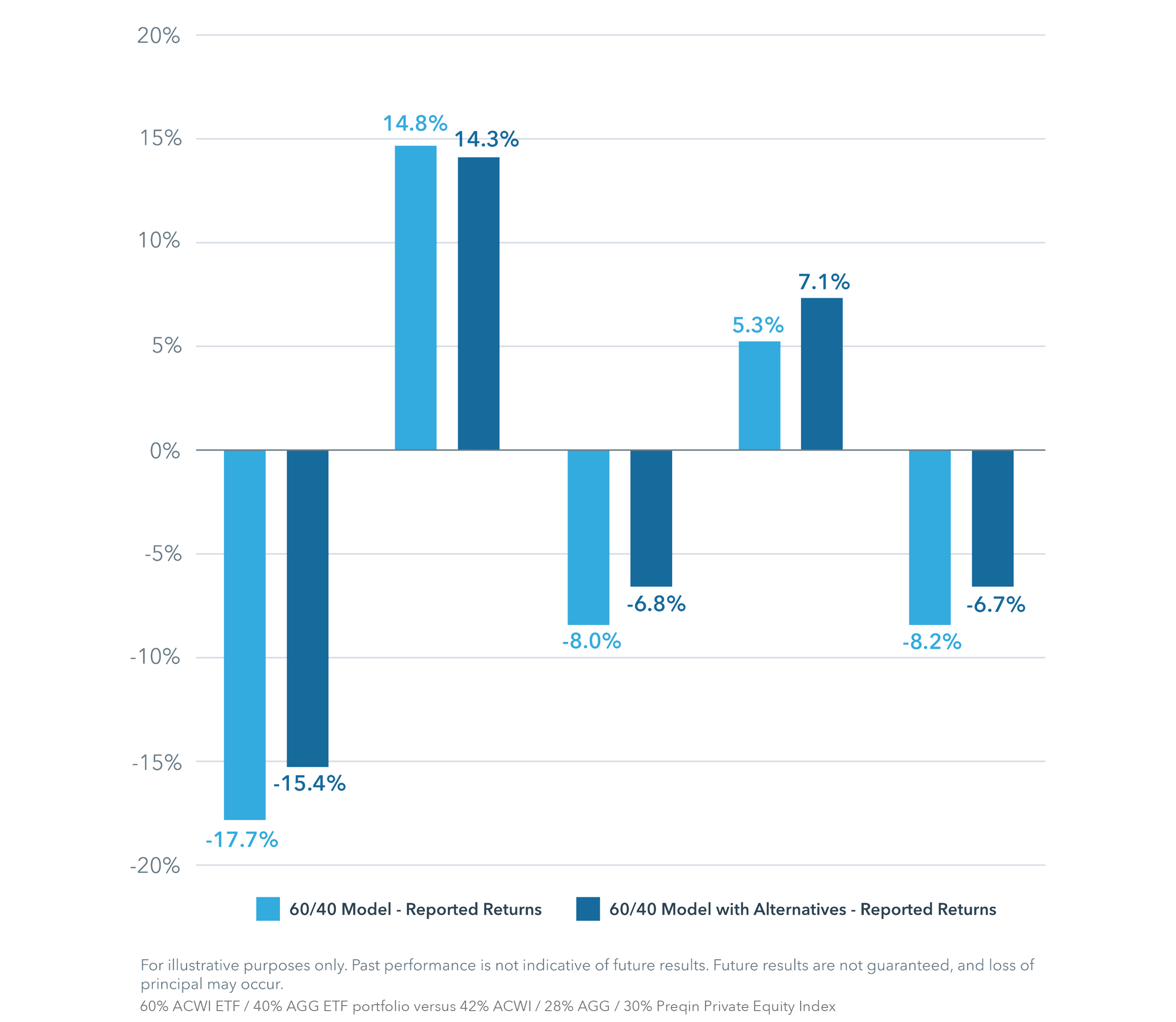

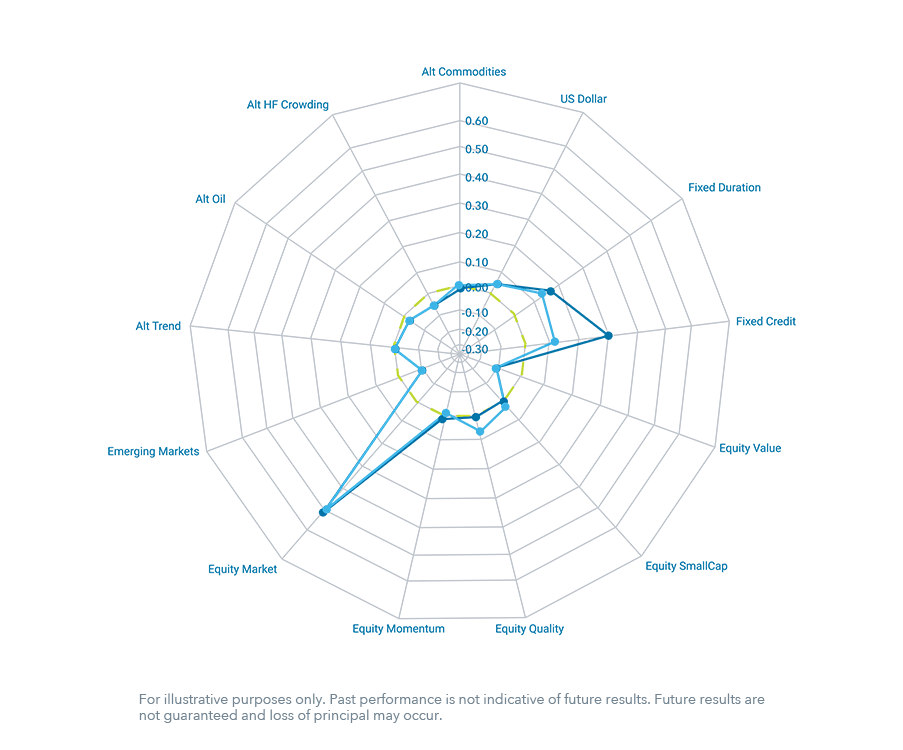

Architect allows advisors to more easily analyze and integrate alternatives and structured investments, which can offer enhanced return, downside protection, and income opportunities to create potentially better outcomes for clients.

BUILD

Your Portfolio Design Studio

Whether you’re new to alternative investing or an experienced veteran, Architect makes it easy to build new portfolios.

Your choice of three easy paths:

1

Do it Yourself. Browse your iCapital alternatives and structured investments menu and add offerings directly into client portfolios.

2

Use a Model. Add a pre-built, outcome-oriented alternative model allocation to your client’s portfolio with a click of a button.

3

Let Architect Guide You. Use Portfolio Allocator to select your client’s desired outcome and investment constraints, and Architect will surface potential investment options.

Currently Beta version of Portfolio Allocator

COMMUNICATE

Enhanced Client Engagement

Architect’s tools and analytics can improve client conversations and set your practice apart from the competition.

Provide a more personalized client experience with print-friendly PDF reports

Empower informed decision making and improve practice management

INVEST

Turns Ideas To Action Faster

Architect equips advisors to easily invest in multi-position models through advanced order entry workflows.

Intelligent automation guides the advisor through each step and requirement

Reduces the complexity of the entire investment process for both the advisor and investor

Provides one-stop e-signature solutions and all-in-one client communications

Grow Your Alternatives And Structured

Investments Business With Architect

1. View detailed description of the awards and selection criteria here.

IMPORTANT INFORMATION

iCapital Architect (“Architect”) is intended to provide certain analytics and comparative charts as a tool for financial professionals to evaluate securities and sample portfolio. You should review the disclosures and methodologies available on iCapital Architect including the terms of use and privacy policy.

iCapital and its affiliates provide various services through a number of affiliated entities – please refer to Certain iCapital Entities for a full list of entities. iCapital entities are collectively referred to as “iCapital”, and they all are affiliated with iCapital, Inc. and Institutional Capital Network, Inc. Among these affiliates, iCapital Markets LLC (“iCapital Markets”), an SEC-registered broker-dealer, member FINRA and SIPC, offers securities products and services. The registrations and memberships listed in Certain iCapital Entities in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services provided by iCapital. Additional information is available upon request.

This website is for informational purposes only. This website is the property of iCapital and may not be shared, reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This website and any information included on it are not intended, and may not be relied on in any manner, as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. Financial products, including investment funds and structured investments, are complex and may be speculative and are not suitable for all investors. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This website and the information contained on it is not intended to, and does not, address the financial objectives, situation or specific needs of any specific investor.

iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc.